Last week, the International Energy Agency (IEA) published a milestone report – Net Zero by 2050: A Roadmap for the Global Energy System. The report seeks to provide a comprehensive study of how to transition to a net zero energy system by 2050 while ensuring stable and affordable energy supplies, providing universal energy access, and enabling robust economic growth.

The report includes:

- an examination of the impacts of announced net-zero emissions pledges and what they might mean for the energy sector

- new energy-sector pathways towards achieving net-zero emissions globally by 2050, including detailed sector-by-sector analysis of the changes that would be needed over the next 30 years, specific technology and policy milestones, and the wider implications for economies and society

- key policy recommendations for governments to act upon in the near-term, and a long-term agenda for change to achieve net-zero goals, including with a view to reaching other Sustainable Development Goals.

Key highlights of the IEA’s modelling and analysis under the Net Zero Emissions (NZE) scenario outlined in the report are summarised below.

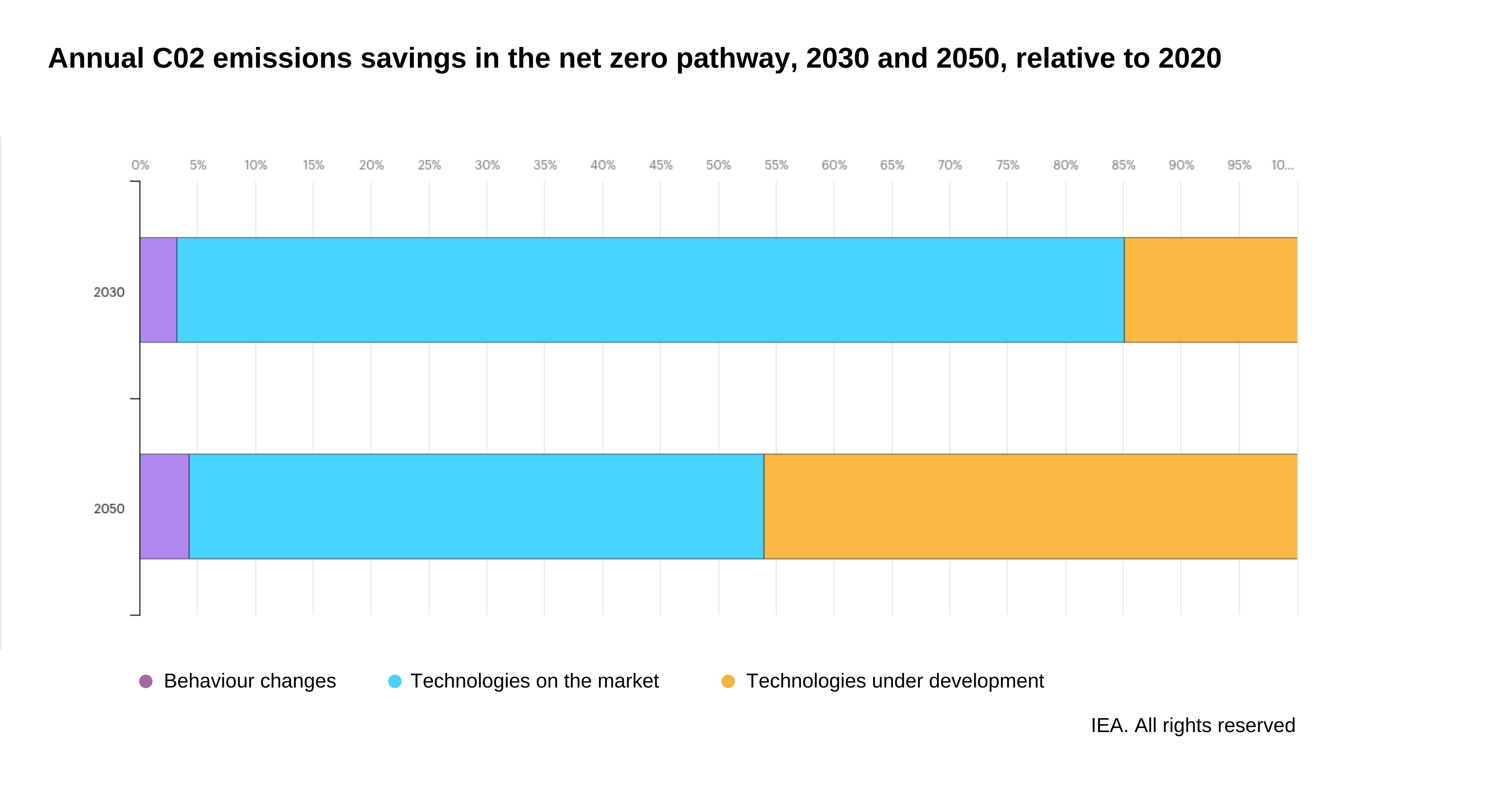

Full decarbonisation requires further development of nascent technologies: Most of the global reductions in CO2 emissions through 2030 come from technologies that are readily available today. However, in 2050, almost half the emissions reductions come from technologies that are currently at the demonstration or prototype phase (such as hydrogen, advanced batteries and direct air capture and storage).

Renewable energy is rapidly deployed at scale: Solar and wind energy reach annual additions of 630 gigawatts (GW) of solar PV and 390 GW of wind by 2030, four-times the record levels set in 2020. For solar PV, this is equivalent to installing the world’s current largest solar park roughly every day.

Solar becomes the ‘king of energy’: Two-thirds of total energy supply in 2050 comes from wind, solar, bioenergy, geothermal and hydro energy. Solar becomes the largest source, accounting for one-fifth of total energy supplies. Solar PV capacity increases 20-fold between now and 2050, and wind power 11-fold.

Fossil fuel demand falls by three-quarters: Fossil fuel use falls from almost 80% of total energy supply today to slightly over 20% by 2050.

No new fossil fuel production is needed: Beyond projects already committed as of 2021, there are no new oil and gas fields approved for development in the IEA’s pathway, and no new coal mines or mine extensions are required. Days after the IEA’s report was released, the G7 and European Union vowed to end international investment in coal. Other governments that continue to provide financing to fossil fuel projects are already facing increased scrutiny in light of the IEA’s report.

Electric vehicle sales surge over the next decade: EVs go from around 5% of global car sales to more than 60% by 2030.

Rapid technology development and deployment is needed to decarbonising heavy industry: In heavy industry and long-distance transport, the share of emissions reductions from technologies that are still under development today is even higher than other sectors. After rapid innovation progress through R&D, demonstration and initial deployment between now and 2030 to bring new clean technologies to market, the world then has to put them into action. Every month from 2030 onwards, ten heavy industrial plants are equipped with CCUS, three new hydrogen-based industrial plants are built, and 2 GW of electrolyser capacity are added at industrial sites.

Methane emissions plummet as targeted measures are implemented: Methane emissions from fossil fuel supply fall by 75% over the next ten years as a result of a global, concerted effort to deploy all available abatement measures and technologies.

Critical minerals represent a huge economic opportunity: The total market size of critical minerals like copper, cobalt, manganese and various rare earth metals grows almost seven-fold between 2020 and 2030 in the net zero pathway. Revenues from those minerals are larger than revenues from coal well before 2030.

Current government funding commitments are highly insufficient: Around USD 90 billion of public money needs to be mobilised globally as soon as possible to complete a portfolio of demonstration projects before 2030. Currently, only roughly USD 25 billion is budgeted for that period.

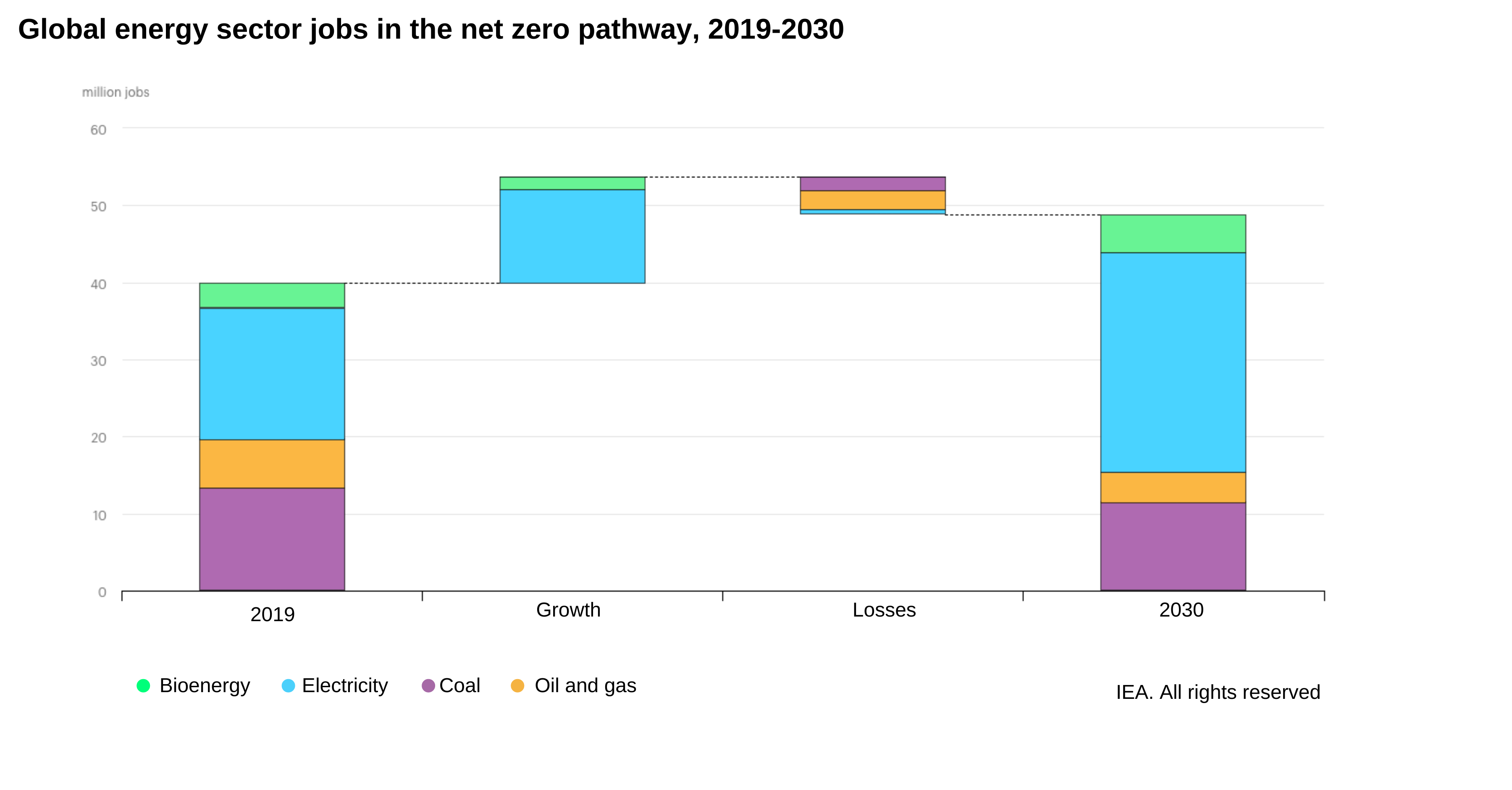

The clean energy transition creates millions of jobs: The transition to net zero brings substantial new opportunities for employment, with 14 million jobs created by 2030 in the NZE scenario thanks to new activities and investment in clean energy.

Flexibility is a valuable and necessary capability in the electricity grid: Electricity system flexibility – needed to balance wind and solar with evolving demand patterns – quadruples by 2050, even as retirements of fossil fuel capacity reduce conventional sources of flexibility. The transition calls for major increases in all sources of flexibility: batteries, demand response and low-carbon flexible power plants, supported by smarter and more digital electricity networks.

Infrastructure investment is needed on a massive scale: Annual investment in transmission and distribution grids expands from USD 260 billion today to USD 820 billion in 2030. The number of public charging points for EVs rises from around 1 million today to 40 million in 2030, requiring annual investment of almost USD 90 billion in 2030. Annual battery production for EVs leaps from 160 gigawatt-hours (GWh) today to 6 600 GWh in 2030 – the equivalent of adding almost 20 gigafactories each year for the next ten years. Annual investment in CO2 pipelines and hydrogen-enabling infrastructure increases from USD 1 billion today to around USD 40 billion in 2030.

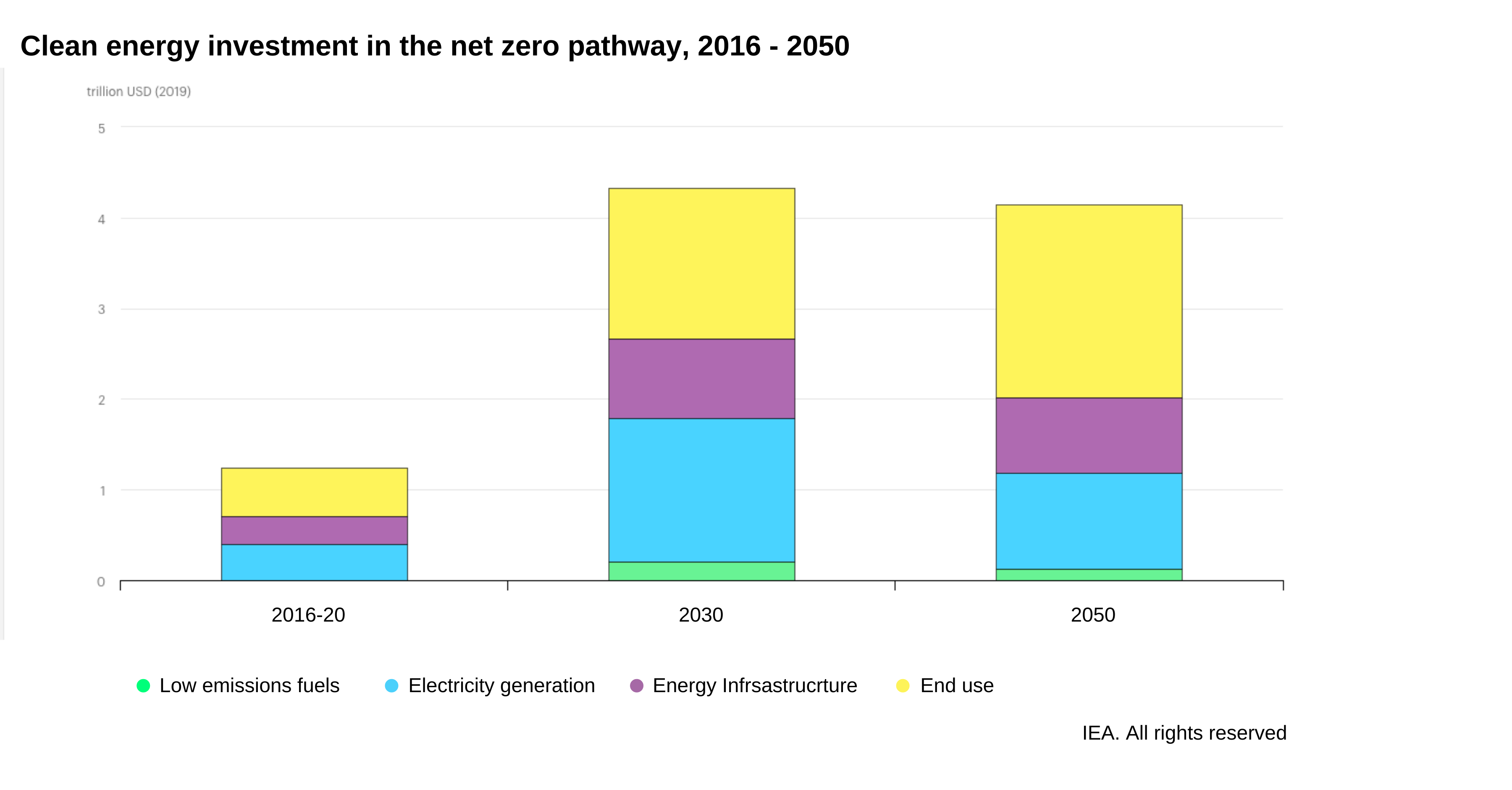

The transition stimulates global economic growth: Total annual energy investment surges to USD 5 trillion by 2030, adding an extra 0.4 percentage point a year to annual global GDP growth, based on the IEA’s joint analysis with the International Monetary Fund.