Partnerships for Nature: insights from Indigenous-led models in Canada

15 April 2025 / WORDS BY Pollination Foundation

read article

London+44 203 355 1556

Sydney+61 2 8313 7109

Melbourne +61 2 8313 7109

Washington +1 872 201 1168

In this second edition of Nature Finance Focus, we highlight a number of models that are helping to unlock and scale nature investment. Some models are well established, alongside others in which we see significant promise and growth. By showcasing these tangible case studies, we aim to provide ideas and options which can be taken up by the global bank or investor, or by the major corporate.

The report also details the findings of our biennial survey of 500 institutional investors across the UK, USA, Australia, Singapore and Japan.

View reportFour years ago, when Climate Asset Management launched as a joint venture between HSBC and recently formed consultancy Pollination, it laid out ambitious plans to become the biggest investor dedicated to natural capital.

11 December 2023 / WORDS BY Veda FitzSimons, Maggie Comstock and William Acworth

The future of the international carbon market hinges on the domestic implementation of the rulebook for cooperation laid out in the Paris Agreement, known as Article 6. Yet frameworks to implement Article 6 are complex and continue to evolve, including through the ongoing COP28 negotiations in Dubai.

As a result, countries face a complex, and sometimes opaque, set of considerations in determining whether and how they engage with carbon markets in the post-Paris Agreement era.

We are delighted to have partnered with the Asian Development Bank (ADB) on its report National Strategies for Carbon Markets Under the Paris Agreement – November 2023: Making Informed Policy Choices.

This report sets out the key strategic questions countries must consider in determining their approach to engaging in international cooperation under Article 6, and a suite of practical policy and operational elements required to underpin engagement.

Below we unpack the fundamental components and considerations for countries in executing on each of these elements.

Countries will need to make a set of strategic decisions regarding the nature of their participation, if any, in the international cooperation established by Article 6.

Country strategies to achieve their NDCs should inform these decisions. Ideally, the policy implications of these strategic decisions regarding Article 6 participation, including processes for authorisation, will be articulated in a publicly available national Article 6 policy.

In determining their national strategy on Article 6, countries should seek to prioritise international carbon finance for mitigation in sectors that are otherwise difficult for the country to finance. This approach aims to maximise benefits to the country from the sale and international transfer of mitigation outcomes.

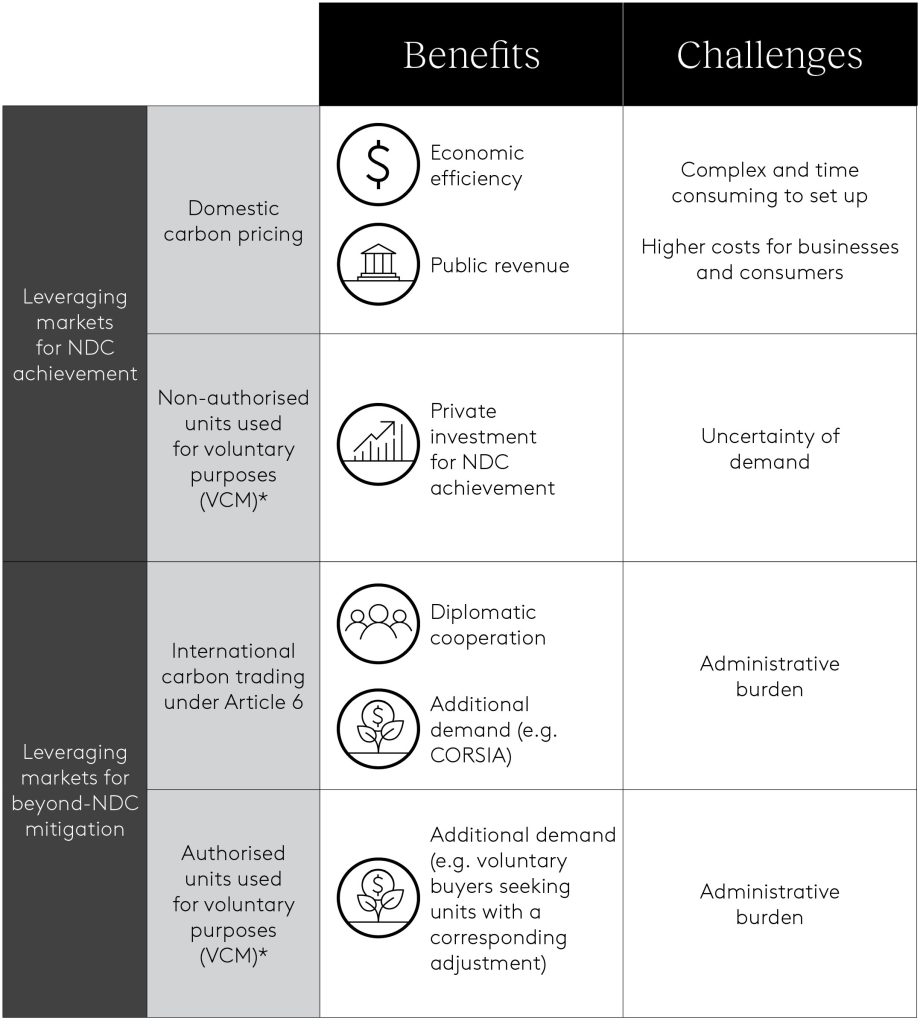

Countries have several avenues through which they could engage in carbon markets to support mitigation activities for NDC achievement and/or beyond NDC mitigation. The table below provides an overview of these choices along with the advantages and disadvantages associated with them. Not all approaches will result in international transfers under Article 6, with domestic carbon pricing and trade of non-authorised credits under the VCM providing finance for NDC implementation. The strategic approaches and the available mechanisms that sit within them are not mutually exclusive, with some countries already combining multiple approaches.

Asian Development Bank, 2023, National Strategies for Carbon Markets Under the Paris Agreement – November 2023: Making Informed Policy Choices

To engage with Article 6 effectively, host countries will require legal and policy frameworks to support the creation, verification, and accounting of mitigation outcomes—including A6.4 ERs—and effectuate their transfer.

Further, although not strictly within the remit of Article 6, countries should seek to establish guidance on claims that can be made by voluntary purchasers of mitigation outcomes generated in the country.

Further detail on each of these elements is provided in the report.

Article 6 transactions must be reflected in country NDC tracking and accounting infrastructure through corresponding adjustments implemented following the Article 6 guidance and rules. Countries will also need to be positioned to comply with the reporting requirements specific to Article 6.

Alongside the legal and institutional requirements to track and authorise mitigation outcomes under Article 6.2 and Article 6.4 for international transfer, the Article 6 guidance and rules envisage several components of accounting and reporting infrastructure to support the operationalisation of Article 6.2 and the Article 6.4 mechanism. These requirements are summarised in the report.

We’re hopeful that the guidance provided in this report will help set a pathway for countries to make the informed and decisive policy choices required as the foundation to high integrity and effective international carbon markets.

This work was undertaken by our global team: Martijn Wilder, Marisa Martin, Rick Saines, Maggie Comstock, Lauren Drake, Will Acworth, Veda FitzSimons, Thea Phillip, Sara Oishi, James Daniel, Fabian Knoedler-Thoma, Alex Bai and Juan Parra.

This summary was prepared by Pollination and drawn from National Strategies for Carbon Markets Under the Paris Agreement – November 2023: Making Informed Policy Choices. It has not been endorsed by the Asian Development Bank.

15 April 2025 / WORDS BY Pollination Foundation

read article

Receive latest news and global perspectives from Pollination.

By clicking submit, you agree to our Terms & Conditions.