With media coverage and commentary on COP30 and the EPBC Act reforms at saturation point, and that has meant that a significant development has received very little attention by comparison: the launch of the International Energy Agency (IEA)’s annual World Energy Outlook.

The World Energy Outlook is an influential annual analysis of the global energy landscape and its potential futures, widely applied by energy sector businesses, financial institutions and policy makers alike. This year’s Outlook recognises that energy issues are core issues for economic and national security and are inextricably linked with prevailing geopolitical tensions. The IEA states that, while it has observed less momentum behind global efforts to reduce greenhouse gas emissions (see: The death of ESG continues to be greatly exaggerated) energy systems are increasingly vulnerable to the physical risks presented by unprecedented warming.

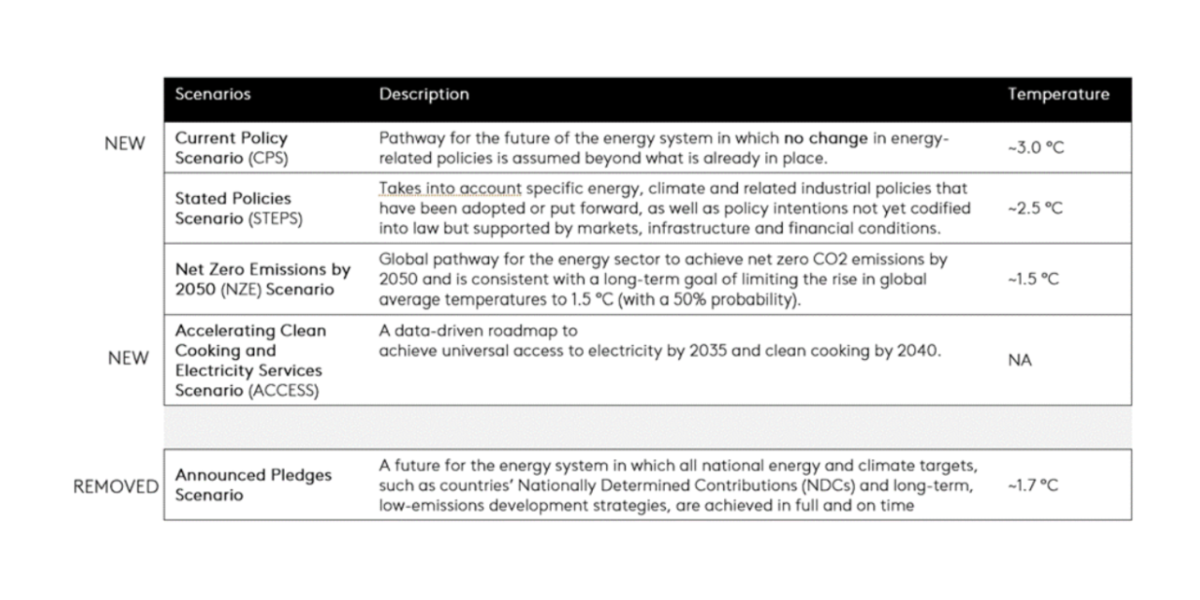

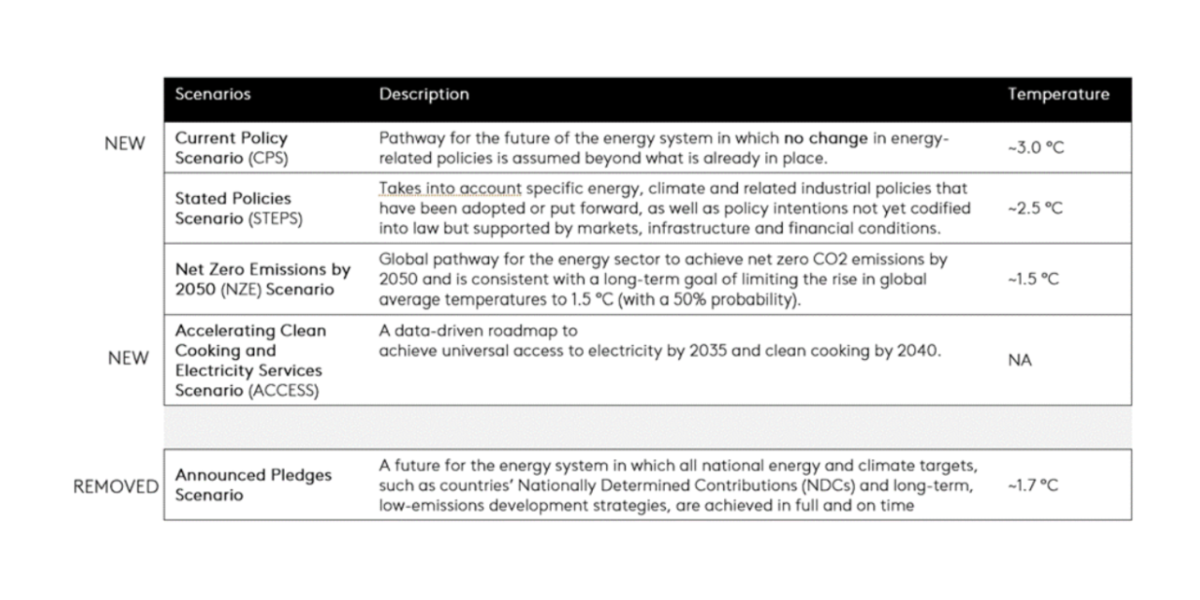

What is particularly notable about this edition of the IEA’s Outlook is the re-inclusion of the Current Policies Scenario (consistent with ~3ºC of global average warming) and removal of the Announced Pledges Scenario (consistent with ~1.7ºC) following reports of pressure from major fossil fuel producers including the US. Of significance to the many Australian companies and institutions who apply the IEA’s Net Zero Emissions scenario as their 1.5C reference pathway, the relevant assumptions under that scenario remained substantively consistent from the 2024 edition. Notably, the IEA considers that the demand outlook for coal significantly declines to 2050 under all scenarios. This shift is driven by the large-scale proliferation of competitive distributed renewables and storage. It’s outlook for oil and natural (fossil) gas, however, is far more variable by scenario: both increasing to 2050 under the Current Policies Scenario, but decreasing under the Stated Policies Scenario (with road passenger transport the biggest variable on demand for oil, and for base power generation in emerging markets and developing economies for gas). Significantly for Australia’s natural resources endowments and industrial policies, the IEA also flags that the significant expansion of renewable generation contemplated under all Outlook scenarios may mean supply shortages for critical minerals including copper, lithium, nickel, cobalt, graphite and rare earths.

Notably, the IEA considers that the demand outlook for coal significantly declines to 2050 under all scenarios. This shift is driven by the large-scale proliferation of competitive distributed renewables and storage. It’s outlook for oil and natural (fossil) gas, however, is far more variable by scenario: both increasing to 2050 under the Current Policies Scenario, but decreasing under the Stated Policies Scenario (with road passenger transport the biggest variable on demand for oil, and for base power generation in emerging markets and developing economies for gas). Significantly for Australia’s natural resources endowments and industrial policies, the IEA also flags that the significant expansion of renewable generation contemplated under all Outlook scenarios may mean supply shortages for critical minerals including copper, lithium, nickel, cobalt, graphite and rare earths.

Which of the Outlook demand scenarios will prevail? On that the IEA remains studiously agnostic – at pains to emphasise that its report hypothesises what energy and related commodity demand may look like under given climate policy trajectories, but not forecasts per se. However, it is interesting to note a more likely outcome based on past form: the IEA has consistently underestimated renewable energy penetration in past Outlooks.

Accordingly, we will watch with interest whether these technologies continue to grow significantly faster than the IEA’s estimates under all scenarios.

This article offers just a glimpse into our thinking on this issue. We provide a range of tailored Insights services to support our clients. For more information or to discuss how we can support you, please reach out Pollination Law Managing Director Sarah Barker, or Head of Knowledge & Insights Kate Hilder, to discuss.

Notably, the IEA considers that the demand outlook for coal significantly declines to 2050 under all scenarios. This shift is driven by the large-scale proliferation of competitive distributed renewables and storage. It’s outlook for oil and natural (fossil) gas, however, is far more variable by scenario: both increasing to 2050 under the Current Policies Scenario, but decreasing under the Stated Policies Scenario (with road passenger transport the biggest variable on demand for oil, and for base power generation in emerging markets and developing economies for gas). Significantly for Australia’s natural resources endowments and industrial policies, the IEA also flags that the significant expansion of renewable generation contemplated under all Outlook scenarios may mean supply shortages for critical minerals including copper, lithium, nickel, cobalt, graphite and rare earths.

Notably, the IEA considers that the demand outlook for coal significantly declines to 2050 under all scenarios. This shift is driven by the large-scale proliferation of competitive distributed renewables and storage. It’s outlook for oil and natural (fossil) gas, however, is far more variable by scenario: both increasing to 2050 under the Current Policies Scenario, but decreasing under the Stated Policies Scenario (with road passenger transport the biggest variable on demand for oil, and for base power generation in emerging markets and developing economies for gas). Significantly for Australia’s natural resources endowments and industrial policies, the IEA also flags that the significant expansion of renewable generation contemplated under all Outlook scenarios may mean supply shortages for critical minerals including copper, lithium, nickel, cobalt, graphite and rare earths.